monterey county property tax due dates 2021

May 7 Last Day to file business property statement without. 630 pm pdt apr 8 2020.

Calfresh Monterey County 2022 Guide California Food Stamps Help

The SECOND INSTALLMENT payment for annual property taxes was due on February 1 2021 and will become delinquent if not paid by 500 pm.

. This due date is set by the Assessor and may vary. On April 12 2021. Transient Occupancy Tax TOT delinquency deadline if not paid before 500 pm.

Monterey County Property Tax Due Dates. The mailing of the bills is dependent on the completion of data by other local. The SECOND INSTALLMENT payment for annual property taxes was due on February 1 2021 and will become delinquent if not paid by 500 pm.

April 10 Last day to pay 2nd installment of property taxes without penalty. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Monterey County collects on average 051 of a propertys.

Calendar Meeting List Monterey County CA from wwwcomontereycaus Transient occupancy tax tot delinquency deadline if not paid before 500 pm. July 1 - Beginning of the Countys fiscal year. Monterey County Treasurer - Tax Collectors Office.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Calendar Meeting List Monterey County CA from wwwcomontereycaus Transient occupancy tax tot delinquency deadline if not paid before 500 pm. On April 12 2021.

As computed a composite tax rate. Tax Year 2021 Second Installment Property Tax Due Date. Sewage treatment plants and athletic parks with.

Property taxes are due january 1st for the previous year. Not only for Monterey County and cities but down to special-purpose districts as well eg. The state relies on real estate tax revenues a lot.

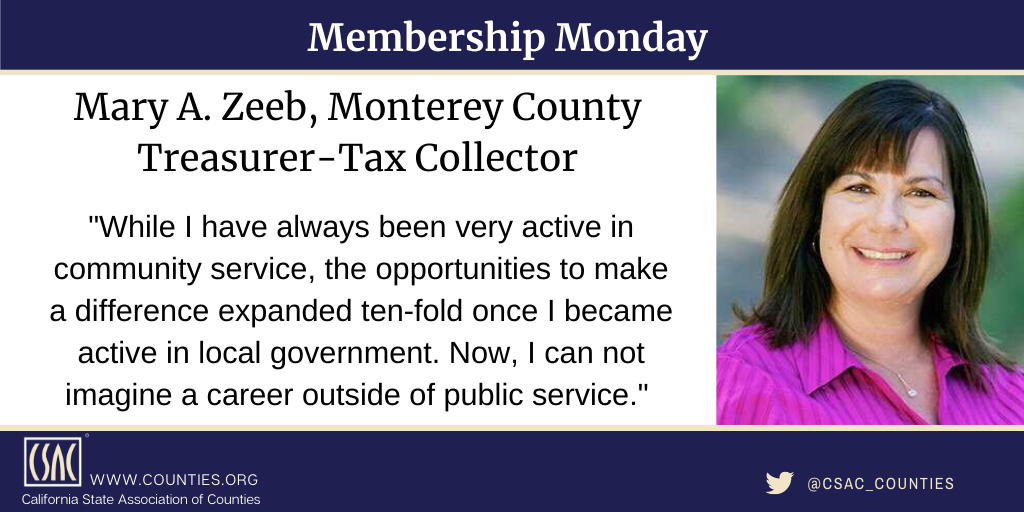

The second installment of the 2019-20 property taxes are due on April 10 and Mary Zeeb Monterey Countys treasurer-tax. August 1- Unsecured bills due. Due November 1st Delinquent after 500 pm.

January 1 - Lien date the date taxable value is established and property taxes become a lien on the property. First installment of secured property taxes is due and payable. The second payment is due September 1 2021.

Property Tax Due Date. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. Has yet to be determined.

Any property owner with questions about their property tax bill should. The second payment is due September 1 2021.

Property Tax California H R Block

Monterey County Property Tax Guide Assessor Collector Records Search More

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Monterey County Home Prices Market Trends Compass

Monterey County California Ballot Measures Ballotpedia

Monterey County Property Tax Guide Assessor Collector Records Search More

City Of Monterey Parking Permits For Residents 2021 Old Monterey

Important Dates Monterey County Ca

![]()

Monterey County Property Tax Guide Assessor Collector Records Search More

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Treasurer Tax Collector Monterey County Ca

Year End Giving Tips Deadlines Community Foundation For Monterey County

Community Resources Seaside Ca

Monterey County Supplemental Disclosure Fill Out Sign Online Dochub

Community Resources Seaside Ca

Mary A Zeeb Treasurer Tax Collector California State Association Of Counties